Canadians, it appears, talk a good game when it comes to turning in–or not turning in–their fellow citizens for cheating on their taxes.

At least the ones in focus groups sure do.

A government-paid research investigation of focus groups across the country earlier this year found participants adamant that they would never “rat” on a person to the Canadian Revenue Agency.

“It is out of the question for participants to turn into informers for the CRA,” reads Leger Marketing’s final report on its investigation.

“None of them would report a cheater to the agency”

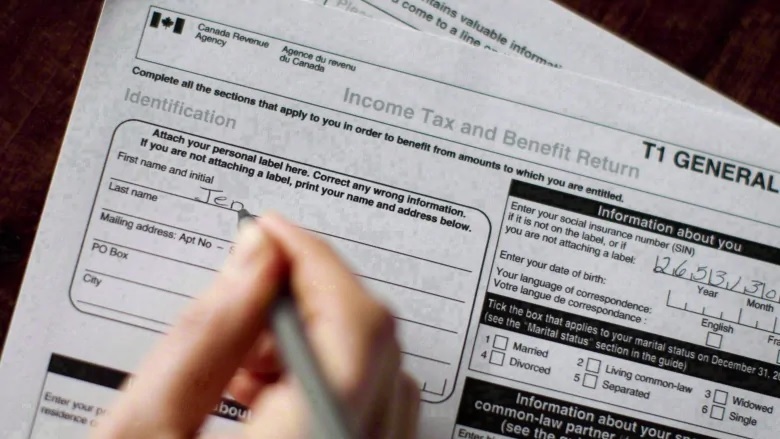

The Candian Revenue Agency received over 30,000 tips about possible domestic tax fraud this fiscal year. (Chris Young/Canadian Press)

Well, hold on a just a sec.

The CRA’s latest figures show it received 32,157 leads for the 2017-2018 fiscal year regarding suspect domestic tax cases.

That’s a tad more that the average since 2013-2014 when just under 30,000 leaders were called mailed, faxed or sent on line.

Over that same period, the CRA says 307 taxpayers were convicted.

“This involved $134 million in federal tax evaded and court sentences totalling approximately $37 million in court fines and 245 years in jail,” CRA spokesperson Etienne Biram told CBC News in an email.

The CRA also has a separate program to report offshore tax evasion.

The program pays informers who provide credible tips, but shows far, far fewer tips being filed.

There were 289 tips in fiscal year 2017-2018. That down from the 494 received when the program was launched in 2014.

With files from CBC News, CP, Government of Canada